Small businesses in India are the backbone of our economy, contributing to job creation and economic growth. This has led to the need to study the impact of technology on small businesses. Accounting for 45 % of industrial production and 40% of total exports, micro and small enterprises (MSEs) contribute one third to the national GDP (Gross Domestic Product).

Yet, scaling up a small business is challenging, especially in monetary terms. Banking systems are slow and rigid in providing loans to small businesses, making it difficult for them to expand their operations. As such, owners need to look into alternate options to suffice their requirements.

The question arises, where do they go when they need financial support?

Traditional Banks? Maybe

Loan-sharks? Definitely, NO!

Is there any solution to this?

Yes, the emergence of technology in business has transformed the landscape of the lending industry, making it easier for them to access credit and grow their enterprises.

In this blog, we explore the role of technology in business’s growth and how MyMoney allows you to take your business to the next level.

To understand the impact of technology in small business, we need to look at the current state of technology adoption among them.

Current State of Technology Adoption Across SMEs

A survey conducted by Tally amongst 2250 MSMEs of different industry verticals across 34 cities in the country revealed that only 35% of SMEs adopted business technology management softwares & amongst them, a mere 40% use digital banking and payments.

But why are the majority of SMEs not adopting technology?

Small businesses don’t invest in technology because of two main reasons:

- They don’t know the benefits or latest trends in technology

- It’s often too expensive for them with their limited capital

Although small businesses face challenges in investing in technology, embracing it can empower them with significant advantages.

Financial automation technology allows SMEs to streamline business operations, reduce costs, increase efficiency, and improve customer experience.

It also helps them to access new markets, expand their customer base, and remain competitive in a changing business environment.

Let’s dive into how financial technologies help SMEs achieve their business goals

- From Long Wait Times to Lightning-Fast Loans

Getting a business loan used to take a long time, but now it’s easier and faster. Fintechs are partnering with lending institutions to consider alternative information to provide loans, such as invoice factoring.

This ensures a smoother, less stringent loan approval process that takes only a few hours.

- Efficiency is Key: Let Financial automation drive SMEs

By automating tasks such as data entry, invoicing, and inventory management, SMEs can reduce the time and effort required, allowing employees to focus on higher-value activities.

- Save with Automation: A Smart Move for SMEs

Automation can help SMEs save money by reducing the need for manual labor and the associated costs of hiring and training employees.

Additionally, automation can help SMEs avoid costly errors and delays.

- No More Human Error

With automated data entry, inventory management, and order fulfilment, there is no longer any room for errors.

This reduces customer complaints and prevents costly mistakes.

- Scaling Up with Ease

Automation can help SMEs scale their operations . By reducing need for manual labor and allowing business owners to handle more orders and customers without adding extra staff.

- Stay ahead of the game

By adopting financial automation, SMEs gain a competitive edge over their peers by improving efficiency, reducing costs, and delivering better products and services.

Conclusion

To sum it up, financial automation is a powerful tool for SMEs looking to improve their productivity, efficiency, and competitiveness.

By adopting the right technology and processes, SMEs can free up their employees to focus on higher-value activities and achieve their business goals more quickly and effectively.

How is MyMoney helping small businesses?

As a small business owner in India, you want to grow your enterprise, but finding the capital to do so is challenging.

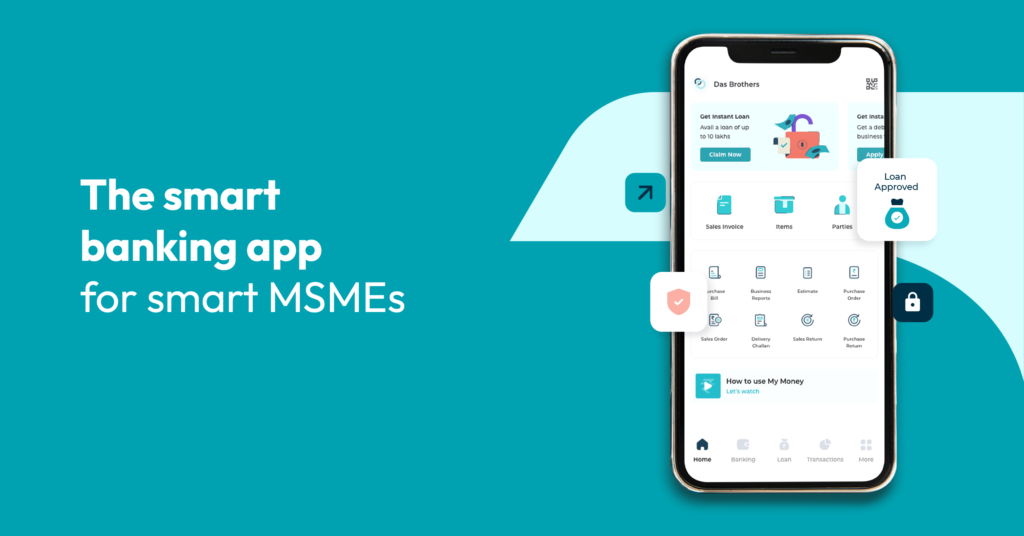

That’s where MyMoney comes in – With collateral-free business loans, zero balance current accounts, automatic payments collection, and invoice generation.

All this with ZERO bank visits or paperwork.

Our user-friendly platform and cutting-edge technology makes it easy for business owners to access the funds they need to take their business to the next level.

So why wait? Download MyMoney today and start growing your business with confidence!