In the last five decades, the MSME sector has emerged as the fastest-growing sector of the Indian economy. The sector contributes significantly to India’s overall economic and social development. It promotes entrepreneurship and generates huge employment opportunities at low capital cost after agriculture. The MSME sector also helps large industries and plays a vital role in the industrial development of the country. The sector is producing a wide range of products and services to meet the demands of domestic and global markets.

Current Status of MSMEs in India

The employment potential of the MSME sector is way higher than the large-scale industries. The income generated through the employment opportunities is helping in reducing the regional imbalances, rapid industrialization is improving the infrastructure of rural areas and overall the country is witnessing a remarkable year-over-year growth. According to the 73rd National Sample Survey conducted in 2015-16, there were 633.88 lakh non-agriculture MSMEs engaged in various economic activities in the country. To know about it in detail, see the image given below.

The everyday problems of MSMEs businesses

Lack of funds for business

The Government of India provides a collateral-free loan scheme under the Emergency Credit Line Guarantee Scheme (ECLGS). A sum of Rs 3 lakh crore is allotted to provide financial assistance to 45 lakh MSMEs of the country. Under this scheme, till August 3, 2020, Rs 1,37,587.54 crore has been sanctioned and Rs 92,090.24 crore has been given to the businesses. However, even after various such schemes by the government, a majority of the MSME businesses keep making the rounds of the bank for loans. And those who get the loan also have to go through very tedious formalities. These are some of the major reasons why most of the businesses prefer or are availing loans from neo banks or NBFCs.

Lack of access to current account

The service of the current account is primarily used for business transactions and it’s a very tedious process to open one. There’s a large chunk of small businesses who use their personal savings account to do business related transactions. One of the primary reasons for this behaviour is that for opening a current account, a lot of documents have to be provided and about Rs 25,000 has to be maintained as Monthly Average Balance (MAB) at all times. Another reason is small businesses are not aware of the benefits that they can enjoy in their day-to-day business through a current account. This is the reason that most of the businessmen manage their business from their personal savings account, which makes it very difficult for them to track their business cash flow.

Managing a business is time-consuming & costly

In 2015, Honourable Prime Minister of India, Shri Narendra Modi launched Digital India campaign. Since then the country has gone digital on a rapid scale. Yet the majority of businesses still manage their business billing, banking, accounting and tax related needs manually. This burns out a huge amount of their time & money. If businesses can have a solution where they can manage everything digitally, then they can save a lot of time & money. The saved time & money can be put to use for their business growth and they can enjoy a proper work-life balance.

Manual errors in accounting & bookkeeping

Accounting and bookkeeping are important for any type of business. It plays a vital role in determining the sales figure, profit & loss ratio and helps in building the overall business strategy. The percentage of errors in manual accounting and bookkeeping is very high that affects the business adversely. There are several other factors that hinder the growth of the MSME business community. With an intention to provide a solution for all these problems — MyMoney has been created.

What is MyMoney?

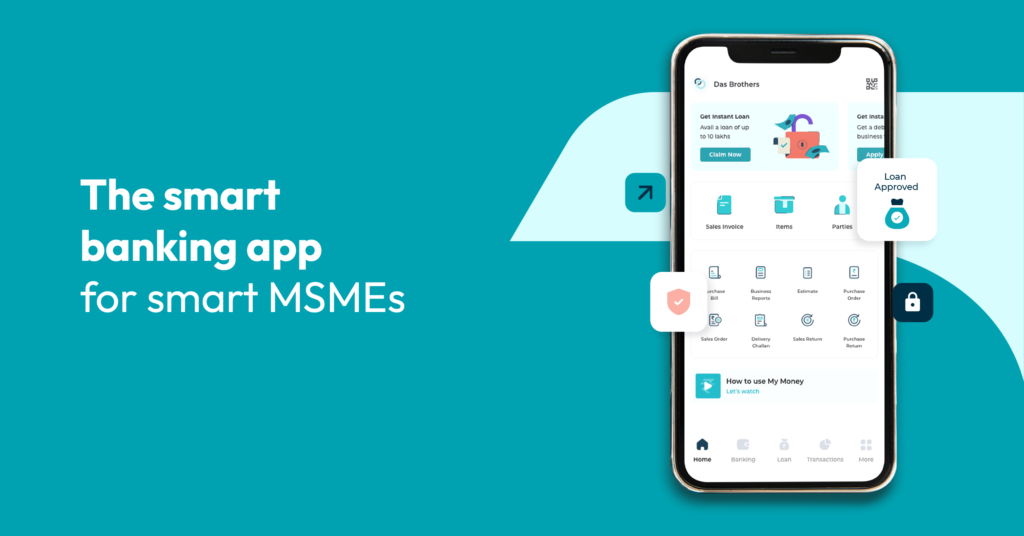

MyMoney is a neo banking app that is specially designed to meet the business needs of MSMEs. It’s very difficult for small businesses to get a current account. The one who gets it, has to go through a lengthy process and it takes 4-5 days to open the account. Apart from this, small businesses need regular cash flow to run their operations smoothly. And no bank gives them quick loans due to the lack of credit history. A lot of their time, money and energy is wasted because of manual accounting and bookkeeping. With MyMoney, MSME businesses don’t have to face these problems and all of their business needs can be fulfilled without any hassle.

How will MyMoney fulfill these needs?

Business Loans

The majority of the MSME businesses face economic problems on a regular basis. They approach the banks when they face any sort of financial difficulties. And often their loan application is rejected and they fall under the trap of loan sharks. Their financial problems can be solved with MyMoney. MyMoney provides quick business loans ranging from Rs. 10,000 to Rs. 10 Lakhs at affordable interest rates. The loan amount can be repaid between 6-15 months as per their convenience. The loan amount will vary depending on their business size and eligibility. Businessmen who have not registered their business can apply for the loan as an ‘individual’. At the same time, businessmen whose business has been registered can apply for a loan as ‘Sole Proprietorship’.

Current Account

As mentioned earlier, MSMEs don’t get current account easily and they end up using their personal bank account for running their business. Now all they have to do is download the MyMoney app and get started. MyMoney offers zero balance current account powered by State Bank of Mauritius. The current account is allotted within minutes once the application process is completed and it takes 24-48 hours to activate the same. The merchants who already have an ICICI Bank current account can link it with MyMoney and see all the bank statements directly in the app itself.

Billing

In the earlier days, businesses used to make invoices and bills on paper. But in today’s digital age, we are seeing a shift in the trend as a lot of them now prefer e-Billing. It saves a lot of manual time and makes the entire billing process more convenient. However, the majority of MSMEs are still running their business through manual billing. One of the reasons here is that most of the billing software is too expensive and complicated for their understanding. This is where MyMoney comes to their rescue by providing the most simplest invoicing solution. The app gives a scope to businesses to create digital Sales Invoice, Sales Return, Purchase Bill, Purchase Return in less time and cost.

Accounting and Bookkeeping

Accounting and bookkeeping are two core aspects of any business. The MSMEs face a lot of challenges in maintaining an accurate accounting process. The biggest reason for this is that they don’t have the budget to hire accountants. The bookkeeping process is also very time consuming and the possibility of manual errors is very high. This affects their decision making process and causes roadblocks for business operations. With MyMoney, businesses don’t have to worry about these challenges as the entire accounting and bookkeeping is automated. The auto-match feature saves endless manual hours of tracking all the business transactions. The time and effort saved can be utilized by them for better prospects of their business and will help them maintain a healthy work-life balance.

The businesses can also use the MyMoney app for various other features like stock updates, payment reminders, business reports and a lot more. MyMoney is designed to cater MSMEs in their overall business and help them scale in the best possible way.

Lone stas pdf

SubbaraoponagantI